Internal audit routinely reviews compliance risk and also should be reviewing business risk. The efforts to control both risk types will purely enhance:

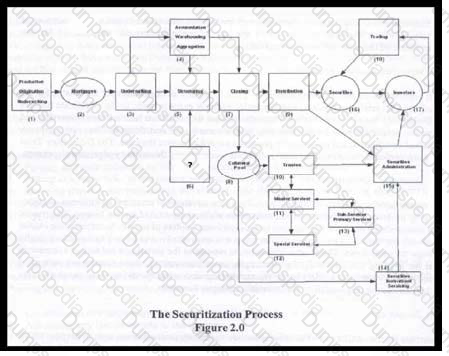

Which of the following should be the next step after the structuring process in order to complete the securitization process?

Strategic Risk if not properly controlled, understood or measured may result in:

Insurance policies are good for insurance needs, however, as a main investment vehicles, they have considerable downsides.

I- Loan Processing

II- Claims Processing

III- Applicating

IV- Credit and Collection

V- Reconciliations

VI- Account Payments

VIII- Time and Expense Reimbursement

IX- Vendor Payments

X- Payroll

These all are the services included in:

IIA’s code of ethics applies to __________ that provide internal auditing services:

Homeowner policies combine property and casualty coverage into the same policy (known as multi-line policies). Homeowner policies provide four types of property coverage. All of the following are out of those EXCEPT:

The most common index funds tries to tracks the S&P 500 by purchasing all 500 stocks using the same percentage as the index. Other indices that mutual funds try to copy include all of the following EXCEPT:

Securities available for sale should be reported at current market value. When this type of security has an unrealized gain or loss:

The entity has comprehensive, written credit risk management policies and procedures for derivative activities. This addresses to:

Deposit accounts are either interest bearing or non-interest bearing. Interest bearing accounts includes _________ and ___________. The types of accounts bear interest for a fixed period of time and are known as time deposits.

All lending institutions assume some loans will not be repaid and thus estimate the losses they expect from their loan portfolio. Management of the lending institution sets a reserve for loan losses at a given point based on factors such as:

___________ help bring performance back into compliance, or address problems that have been identified such as employee grievance system, employee performance approvals, or an administrative appeal’s process.

Exception reports generated by the lending institution are designed to identify past-due loans. Auditors should review these exception reports to identify an unusually high number of exceptions and old or unusual exceptions that might indicate that:

An area of FOMC board responsibilities is the development and administration of regulation that implement major federal laws governing consumer credit, such as:

Asset Management is the term usually given to describe companies that run manual Funds. The largest are those who provide:

__________ agency system uses agents who sell the policies of a group of affiliated companies.

Regulation D, an SEC rule governing the limited offer and sale of securities without registration under the securities Act of 1933, regulates private placement exemptions. Regulation D supports all of the following EXCEPT:

Electronic financial services audits should focus on whether there are adequate internal controls in place to protect customer transactions information, and assets. Some key steps in clued all of the following EXCEPT:

_____________ loans allow the consumer to repay a loan over a set period. They require periodic principal and interest payments The loan is generally secured by the item being purchased. Automobile loans or real estate mortgage loans are common types of such types of loans.

Many group disability income policies contain a physical examination provision that requires a doctor to examine a claimant before the claim is paid. The insurer may also require the claimant to undergo periodic examinations to verify:

Derivates can be effective low cost tools for managing expose experience losses due to:

_____________ is a type of insurance that employers provide for employees. Injured employees must file with the agency that administrates it in their state and notify their employer. It pays: Medical expenses for employees and rehabilitation benefits for employees who become disables through work Death benefits for survivors of employees who die because of an occupational injury or disease

It is a contract that defines corporation and bondholders responsibilities and is designed to protect the right of the bondholders. A trustee (most often a commercial bank) is generally appointed to ensure that the obligations defined in the agreement are of trust indenture must e filled with SEC. What is it?

Auditors should be aware that the investment objectives of a mutual fund are usually based on a risk profile outlined in the fund prospectus. For example, aggressive growth funds may invest in highly volatile stock issues and a money market fund may invest in lo –risk money market instruments. Other funds have investment objectives based on the type or location of companies they invest in, such as:

Most municipal and corporate bonds are rated by an independent rating firm such as Standard & Poor’s (S&P) or Moody’s. These ratings provide investors with information regarding the risk of default on the bond issue. The higher rated bonds are considered _________.

Auditors testing mutual funds transactions will typically focus on whether customer purchases and redemptions are accounted properly. In cases where brokers are used to maintain customer accounts, auditors may need to confirm:

The plans developed for the audit functions should be updated as circumstances dictate. Such specific types of plans include all EXCEPT:

Engagement client management often has a negative perception of audit process; therefore, communication throughout the audit process is essential to alleviate some of the concerns of management. The very first step in communicating the audit information with the client is:

Which of the following is NOT included in the list of principles for formulating well- stated audit objectives?

If a mutual fund has an NAV of $100 million, and investors own $10,000,000 of fund’s shares, the funds per share value will be:

When one buys a cash instrument, for example 100 shares of ABC Inc., the payoff is linear (disregarding the impact of dividends). If share are purchased at $50 and the price appreciated to $75, we have ________ on a mark-to-mark basis.

A participant’s right to receive partial or full benefits under a private retirement plan even if the participant terminates employment prior to retirement is referred to as

Business continuation insurance protects a business against the potential economic loss resulting from the passing or disability of key executives and/or employees. This is the insurance coverage which comes under the umbrella heading of:

Charitable trust that is an irrevocable trust and that may be testamentary or inter-vivos (Between living persons) is called:

One fund may invest on mostly established “blue chip” (Companies that pay regular dividends). Another fund may invest in newer technology companies that pay no dividends but that may have more potential for growth. These are the examples of:

There are different classes of mutual funds. Classes that typically do not have a front-end sales load. Instead they may impose a contingent deferred sales load and a 12b-1 fee (along with other annual expenses) is called:

Recent activities in the marketplace have caused your company to comply with requests from 50 percent of your policyholders to cancel their policies. The company complies and refunds them amounts due. Your audit of this should ensure these refunds were charged against what account?

The “combined ratio” of an insurance company is the ratio from combining which of the following?

I. The “loss ratio.”

II. The “other underwriting expense ratio.”

III. The “expense ratio.”

IV. The “IBNR.”

The duties of a guardian in guardianship arrangements are similar to those of a trustee.

Specifically, the guardian is obligated to:

1) Protect and preserve the assets

2) Submit an inventory and appraisal to the court

3) Retain or divest assets

4) Use principal and income for the benefit of the ward

5) Submit an annual accounting to the court

____________ is an electronic payment network used by individuals businesses, financial institutions and government organizations. It provide better cash management capabilities and lower costs than traditional paper payments.

Which one of the following statements elaborates some insurance products that fall under the regulatory authority of SEC?

If a corporation has an asset sensitive gap in a rising rate environment, which of the following would be considered an appropriate hedging strategy to prevent a decrease in net interest income?

In SEC review process, if SEC believes that the registration statement contains false or misleading information or that pertinent information has been omitted, it can suspend the process with______________.

Banks that performs variety of services for other bank, e.g. they make emergency loans to banks that are short of cash and clear cheques that are drawn and paid out by different banks are called:

Leases allow a customer to use an institution’s property for a specified period. Most lease agreements give the lessee the option of purchasing the property:

In variable life insurance the number and type of insurance choice available are dependent on insurer, but some policies are available with a wide variety of separate accounts also known as: