A trust which is created and operating during the Grantors lifetime is called________________

_________ is the most appropriate method for donors who prefer to make gifts at the end of their life and _________ is the most appropriate method for donors who prefer to give gifts during their lifetime.

In which of the following case/cases Revocation of Power of Attorney is possible?

As per the Payment of Gratuity Act, the employer shall pay the amount of gratuity within _________.

Which of the following statement(s) about “Special Needs Trust” is/are correct?

Which of the following statement(s) about Uniform Gifts to Minor Act (UGMA) is/are correct?

According to__________ of the ‘Registration Act, 1908’ the registration of a Will is not compulsory.

As per Section 164(1) a trust for the benefit of an unborn person is liable to income tax at maximum rate of Income Tax, currently_________.

There are__________ methods of Business valuation.Out of these methods,___________ method applies discount rate to determine the valuation of the business.

In context to Workmen’s Compensation Act, any claim for the compensation should be made within _________ of the occurrence of the accident or from the date of death.

There are generally________ types of Private Foundations. Out of these, in ____________ arrangement, the donor has no direct participation in any charitable work.

Which of the following statement(s) about ‘Whole Life Insurance’ is/are correct?

You are an Estate Planner. A client gives you the following information (given below in Table).

You are required to make Quick Estimate of Estate’s liquidity. All figures are in Rupees. The estimate in this case is ______________

You are an Estate Planner. A client asks you to explain him the process of Probate. You explain him that Probate is one of the ways to pass ownership of estate property to a decedent’s survivors. The client further asks you to outline the various steps of Probate. As an estate planner, you would outline the steps of probate as follows (please specify the correct order)

Under ______________, deduction (special exemptions) in respect of donations to certain funds, charitable institutions etc. is granted. In order to be eligible under this section, the charitable trust/institutions need to obtain a valid certificate by making an application to them on ____________.

Mr. Sumit is an employee of Genesis Ltd. His basic pay is Rs.24,000 p.a., Dearness Allowance Rs.12,000 p.a; Medical Allowance (fixed) Rs.10,000 p.a.; Conveyance Allowance Rs.6,000 p.a.; Professional Tax deducted from his salary Rs.1,000 p.a.; Free lunch provided during office hours valued at Rs.12,000 for a 300-working day year; free education for two children in a school owned and maintained by the employer – school tuition fee for both the children is estimated at Rs.18,000 p.a.

What is Net Income of Mr. Sumit and examine whether he is a specified or non-specified employee?

Choose the amount of final tax liability of Mr. Raj for the assessment year 2007-08:

Tax slab for male / HUF(for AY 2007-08)

Rs. 0 to 100000 — No Income Tax

Rs. 1,00,001 to 1,50,000 — 10%

Rs. 150001 to 2,50,000 — 20%

Rs. 2,50,001 and above — 30%

Note: A surcharge of 10% on income tax amount is payable if total income is exceeding Rs. 10,00,000 and a 2% education cess is payable on the income tax amount and surcharge.

Mr. Subhash Bansal, a marketing manager is employed with IMFB limited. He took an advance of Rs. 1,20,000 against the salary of Rs. 30,000 per month in the month of March 2007. The gross salary of Mr. Adhikari for the assessment year 2012-13 shall be:

Mr. Arun mortgages a certain plot of building land to Mr. Sumit and afterwards erects a house on the plot. For the purpose of his security, Mr. Sumit is entitled to ______________.

As per ______________ of Income Tax Act every member of the HUF before partition shall be jointly and severally liable for the tax on the income assessed of the HUF.

You are a Trust and Estate Planner. Mr. Sumit, your client comes out you with the following data and wants to know for which the years he is resident or not.

He left UK on 10th March 2008 to work full-time abroad and visited UK for:

74 days in the tax year 2008–09; 98 days in the tax year 2009–10; 92 days in the tax year 2010–11; 79 days in the tax year 2011–12

Assume the following only for this question:-

320 days in the remainder of the tax year 2008-2009;365 days in the tax year 2009-10; 366 days in the tax year 2010–11; 366 days in the tax year 2011-2012.

Your reply to Mr. Sumit is –“For the year 2009-2010 you are ______________, for year 2010- 2011 you are _______ and for the year 2011-2012 you are ______________”

Under English law, an individual acquires at birth the domicile of the person on whom he or she is legally dependent, which the individual retains until reaching the age of _____________.

Deduction u/s 80-IC regarding special provisions for enterprices in special catogries states is allowed to the extent of:

Compulsory maintenance of account is required u/s 44AA of IT, if the gross receipt/ total sales exceed _______

Mr. Pramod Jain (age 40 years) has life interest in a Trust property. The annual income from Trust property for last three years is as under:

The Trust has spent Rs. 5,000/- per year for collection of the income. The value of life interest of Re 1/- at the age of 40 is Rs. 10,093/-. The value of the property on the valuation date is Rs. 5 lakh. Find the value of life interest.

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be __________.

An assessee was allowed deduction of unrealized rent to the extent of Rs. 40,000 in the past although the total unrealized rent was Rs. 60,000. He is able to recover from the tenant Rs.45,000 during the previous year on account of such unrealized rent. He shall be liable to tax to the extent of:

In case of Amputation through shoulder joint, what is the Percentage of Compensation given (as per Workmen’s Compensation Act)?

A person is deemed to have attained majority on completion of __________________ in case where a guardian of a minor’s property is appointed under the Guardian and Wards Act,1890.

_________________ can be used as an alternative to the outright gift and ___________ can be used as an alternative to a traditional short term pledge.

Mr. Raj, the intestate, leaves no brother or sister but leaves his mother and one child of a deceased sister, Mary and two children of a deceased brother, George. How will the Estate be distributed?

In __________, a protective trust is a type of trust that was devised for use in estate planning.

_______________ is a Life Insurance Trust with certain provisions that allows gifts to the trust to qualify for the annual gift tax exclusion.

A Diety is entitled to initial exemption of __________________ in respect of its income.

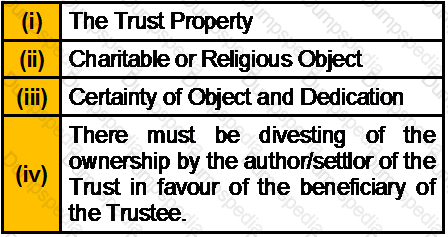

Which of the following is/are essential(s) of a valid Charitable or Religious Trust?

Under _______________ of the Transfer of Property Act, a transfer of property can legally be made for the benefit of an unborn person.

A Discretionary Trust can be formed for the benefit of ________________________

A Discretionary Family Trust is one of the most common small business structures in _____________. It can operate upto ____________ in the same.

_____________ of the Income Tax Act, 1961 provides that where a trustee receives or is entitled to receive any income on behalf of or for the benefit of any person under an Oral Trust, tax is to be charged on such income at the maximum marginal rate.

Competency to contract has been defined under ____________ of the Indian Contract Act,___________

______________ of the Income Tax Act provides for the registration of a Charitable Trust. _____________ of the Income Tax Act contains the provision that the profits and gains of the business carried on by a charitable trust would be fully exempt from tax if it is attains the objects of the trust.

________________ is a popular mode of transfer of property to God or Almighty, under the Mohammedean Law.

Private Sector hospitals, which are formed under a trust as a society, would be exempt from the tax if the annual receipts of such hospital or institution do not exceed _______________ as per Section 10(23(C).

______________ of the Transfer Property Act permits the transfer of property only to one or more living persons.

The Gift Tax Act came into force on _________________ and was deleted vide the Finance Act,__________.

Under provisions of _________________ it is provided that the profits and gains of business of a private trust is chargeable to income tax at the maximum marginal rate with effect from Assessment Year 1985-1986.

The defined period for fraudulent transfers under the Bankruptcy Code was formerly ____________prior to the debtor’s filing for bankruptcy. This period was ____________ by the Bankruptcy Abuse Prevention and Consumer Protection Act of ___________.Transfers to self-settled trusts may be recaptured if made within _________ of the debtor’s filing for bankruptcy if the transfer in trust was made with the intent to hinder, delay or defraud present or future creditors.

Mrs. Brown is a widow with four children. Her husband left his estate completely to her on his death. When Mrs. Brown dies, her estate on death includes:-

The funeral expenses of Mrs. Brown amount upto £1,900. Find out the amount of estate that would be distributable to each beneficiary.

In US, a separate rate structure applies to capital gains and dividends. Under present law, for 2013, the maximum rate of tax on the adjusted net capital gain of an individual is 20 percent for singles earning over __________and couples earning over _______________.

Which of the following statements about Earned Income Tax Credit (ETIC) is are correct?

Sections _____ to______ of the Hindu Succession Act, 1956 lay down the general rules as to the order of succession when a Hindu male dies intestate.

_________ means the amount of _________or its equivalent value in money payable under the Muslim law annually by a Muslim during the month of Ramadan to be used for religious or charitable purposes recognized by the Muslim law.

Which of the following statement(s) about Offshore Investment Bond is/are correct?

A Henson Trust in Canadian law, is a type of trust to benefit _________________

____________ lease is typical for business institutions and organizations whose operations rely on a seasonal schedule. ______________ is an option often taken by new businesses which have no credit history.

Mr. Shikar wants to invest his savings in an account that pays an interest rate of 9.25% p.a. compounded annually at different ages of his son whose current age is 4 years. Please calculate for him the Future Value of these investments when his son turns 18.

From the following information of assets assets and liabilities, the taxable wealth for:

A person is deemed to be UK resident for fiscal purposes if in any tax year he/she lives in UK for more than ____________.

________________ is validated by attaching an affidavit which is signed by the witnesses in the front of Notary Public.

When a deceased dies issueless leaving a widow there is no question of a deemed partition under ___________ of the Hindu Succession Act.

In India where the Registration Act, 1908 is in force, the Power of Attorney should be authenticated by a______________.

The threshold amount for tax on Net Investment Income is __________in the case of a joint return or surviving spouse, _________in the case of a married individual filing a separate return.

One person is said to be ____________ of other if the two are related by blood or adoption but not wholly through males.

Muslim law recognizes that person cannot dispose of by Will more than ______of the net assets (unless ratified by all the heirs of the person leaving behind the Will) while the remaining _________ should be made available for distribution among the heirs.

In Singapore, if the dependent (aged parent) is not less than 55 years of age living with his son in the same household and whose income was not more than $4,000 in that year, deduction of ___________ is allowed in such a case.

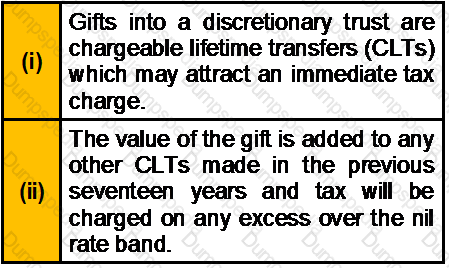

Which of the following statement(s) about Chargeable Lifetime Transfers is/are correct?

Singapore personal tax rates are capped at _________ for residents and a flat rate of ________ for non-residents.

If the adoption is by a male and the person to be adopted is a female, the adoptive father should be at least _______________ older than the person to be adopted. In case, the adoption is by female and the person to be adopted is a male, the adoptive mother should be at least_________ older than the person to be adopted.

Dinesh is entitled to a basic salary of Rs. 5,000 p.m. and dearness allowance of Rs. 1,000 per month, 40% of which forms the part of the retirement benefits. He is also entitled to HRA of Rs. 2,000 per month. He actually pays Rs. 2,000 per month as rent for a house in Delhi. Compute the taxable HRA.

As per Workmen’s Compensation Act, in case there is default in paying compensation .

X owns a piece of land situated in Varanasi (Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-).On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.5 lakh. X does not dispute it. [CII-12-13: 852,11-12: 785,10-11:711]

In case of self occupied property, higher deduction u/s24(b) for interest on loan for construction can be claimed if borrowing was made

Scholarship received by a student was Rs. 2,000 per month. He spends Rs. 15,000 for meeting the cost of education during the year. The treatment for the balance amount Rs. 9,000 is:

As per Hindu Adoptions and Maintenance Act, 1956, which of the following statement(s) is/are correct?

__________ is a arrangement wherein lessee and lessor agree to a payment schedule where for a set period of time, there is no payment and penalty.

With respect to Workmen’s Compensation Act, if distinction is made on the ground of duration of incapacity it may extend to

Incase of Divorce by mutual consent, on the motion of both the parties made not earlier than __________ after the date of the presentation of the petition and not later than____________ after the said date, if the petition is not withdrawn in the meantime, court shall, on being satisfied on all grounds pass a decree of divorce declaring the marriage to be dissolved with effect from the date of the decree.

Saptarshi acquired shares of G Ltd. on 15.12.98 for Rs. 5 lacs which were sold on 14.6.11 for Rs. 19 lacs.

Expenses on transfer of shares Rs. 40,000. He invests 8 lacs in the bonds of Rural Electrification. Corporation Ltd. on 16.10.2011. Compute capital gain for the assessment year 2012-13.

______________ means a contract in which advance payment is made for good to be delivered later on. ____________ is a special kind of partnership where one partner gives money to the other for investing it in a commercial enterprise.

As per Gift Tax Act of 1958, a gift in excess of _________ received by anyone who is not your blood relative is taxable.

Compute Gross Total income and amount of loss allowed to be carried forward to next year:

Which of the following statement(s) about ‘Knock for Knock Agreement’ is/are correct?

As per Hindu Adoptions and Maintenance Act,1956 a female Hindu can make adoption in which of the following cases

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is