if a company increases the price of its product from $3010 $35, demand would decrease from 30, 000 units to 20.000 units. What is the price elasticity of demand for the company using the midpoint formula?

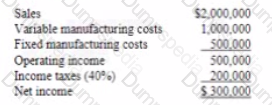

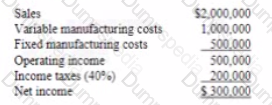

Given the financial information shown below, what amounts would be shown for sales revenue and for gross prom, respectively in a common size income statement?

Marsalls Products Inc. manufactures and sells two products CD-ROMs and DVD's. The latest forecast on me products and their costs tor the coming year is shown in the following table.

Note 1: Fixed manufacturing cost of Si.500 000 per year is allocated to products based on the number of machine hours required to produce the product at a rate of S3 per machine hour

The Manufacturing Team leader just informed the CEO that a fire occurred at one of the manufacturing lines and that line would be unavailable for the next 12 months. The result is that mere will only be 400 000 machine Hours available The CEO requested the management team to revise the plan for the coming year based on the new constraint. The Marketing Team leader stated that in order to minimize customer complaints about the shortage, a minimum of 100,000 units of each product should be produced With the new information from the Manufacturing and Marketing teams what is the optimal product mix for the coming 12 months'' Assume Marsalls can sell allot its production.

Slam-Dunk Shoes has 5,000 pairs or damaged shoes in inventory. The cost of these shoes was $51,000. in their present condition, the shoes may be sold at clearance prices for $29,000 Slam-Dunk can have the shoes repaired at a cost of $77,000 after which they can be sold for $100,000. What is the opportunity cost of selling the shoes in their present damaged condition?

Willcox Company plans to sell 100 000 units of Us only product for $300 per unit to its existing customers It has received a new customer request for 10,000 units at a selling price of $2S0 per unit Willcox's cost structure is shown below.

Capacity exists lo produce an additional 10 000 units and accepting the order would have no long-term implications If the order is accepted however a specialized piece of equipment costing S25 000 would need to I purchased If Wilcox accepts the special order its income would increase by

Javier makes hand-looted learner dog collars. The materials cost $10 per collar and the collars are sold for $50 each. Javier sells me collars at a local farmer's market mat charges S100 per month for space rental if Javier's income tax rate is 30%, how many collars must Javier sell each year to earn $1,000 net income?

A retail company sells numerous products m its one department store. The income statements tot two of these products are shown below

After reviewing the income statements, the president is considering drooping one or both products. Which produces), if any should the company discontinue?

A manufacturing company is reviewing the budget for one of its component parts for next year based on the need for 5.000 units.

The company receives a bid from a supplier offering lo provide (lie needed component for a price of $115 per unit The company is deciding whether to make or buy the component What decision should the firm make if (1) the fixed facilities costs can be avoided or (2) if the fixed facilities costs cannot be avoided If purchasing from the supplier?

Which one of the following statements regarding portfolio diversification is not correct?

It there is sufficient capacity to fill the order, which of the following are relevant for a special order decision?

A company has hired a consultant to propose a way to increase the company's revenues. The consultant has evaluated two mutually exclusive projects with me following information provided for each project.

The company uses a discount rate of 9% to evaluate both projects Based on the net present value, the company should invest in

The human resources manager of BankUS has noted mat me company s employee turnover has increased. He has also had his budget cut, and will have to reduce training for new associates. He has a meeting scheduled with the CFO lo go over risks that his department faces. What should the human resources manager tell the CFO about risk?

The internal audit division of a company is investigating a potential fraud in the Accounts Payable department Someone in the department has been writing checks to fictitious vendors and collecting the cash The primary suspect Is an employee who has own with the company for twelve years and recently lost his Did for promotion to Director of Accounts Payable a position which would have given mm a 25% salary increase This employee has been heard complaining to several other employees in the department that he was cheated out of his raise. Which one of the following elements of the fraud triangle is this employee exhibiting?

When evaluating a capital Budgeting proposal, an advantage of using the payback method is that Bits process

Determine whether me €300 fee is a facilitating payment

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Explain one reason each Tot and against issuing bonds with a call feature

Essay

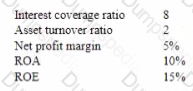

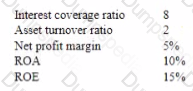

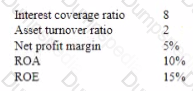

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Explain me concept of relevant cost in the season-making process and discuss whatever the €200, 000 course development coil is relevant to OLi's price decisions in future years

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Identify the market structure in which OLI operates and explain how OLi's pricing is affected by this mantel structure

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Explain two potential benefits for Guda if it acquires Blue Moon.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Identify and explain two risks that Guda may face after it acquires Blue Moon.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

How many units should be produced and sow it AMI'S target net income is $600,000? Snow your calculations.

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Discuss whether QDD stock provided a return that was Better, worse, or the same as its investors would have expected using CAPM snow your calculations

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Explain why facilitating payments can create possible ethical and legal issues tor a company

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Calculate QDDs financial leverage ratio show your calculations

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Explain the impact of a sales price adjustment on AMI’s operating income if AMI’ s operating leverage is higher than that of other companies in its market.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Discuss whether the demand for OLI’s new business English course is elastic and explain how OLI can use this information in determining the product price.

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

According to the IMA Statement of Ethical Professional Practice, identify and explain the standard(s) that Matthew would violate if he chooses not to report the issue regarding the accounting manager.

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Identify and describe two defenses Blue Moon could use if it does not wish to be acquired by Guda.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Explain now QDD's share repurchase plan would affect each of the following measures EPS, the degree of operating leverage, and the interest coverage ratio No calculations required

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Identify and explain two ways for AMI to hedge its exchange rate risk.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Discuss whether AMI should use a cost-based or a market-based pricing approach. Explain your answer.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)

Assuming mere are no other imitations, should AMI accept the one-time order from a financial perspective? Explain your answer

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.