Under the Immigration Reform and Control Act, employers and employees are required to complete which of the following forms:

The entry to record an employee's repayment of a salary advance is (salary advance is deducted on a pretax basis from regular wages):

A service company sends employees overseas on assignments that last no more than 4 months at a time. Which of the following is true with respect to the taxation of those employees?

If a company is examining the feasibility of purchasing an integrated human resource information system (HRIS), what approach is best?

The final due date for the second quarter Form 941, assuming that the employer paid all taxes on time is:

An employer may accept a child support order directly served from another state without risk of liability under which of the following laws?

An employer that deposits payroll taxes semiweekly incurs a tax liability of $55,000 on Tuesday and a liability of $110,000 on Wednesday. When should the taxes be deposited?

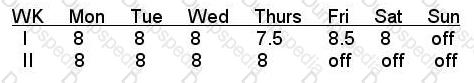

Under the FLSA, how many hours would be paid at time and one half for the following biweekly period, assuming that the employee is an garment worker?

Under the FLSA, how long are employers required to keep records relating to wages, hours, and conditions of employment?

An employee earns $9 per hour and an additional 10 cents per hour for hours worked after 7:00 p.m. If an employee works from 3:00 p.m. to 11:00 p.m., Monday through Friday, what is the employee's weekly gross pay under the Fair Labor Standards Act?

A company has a gross payroll of $120,589.36. Federal taxes withheld are $24,117.87; combined social security and Medicare taxes withheld are $6,502.50. What is the company's total tax liability for this pay period?

The FLSA requires which of the following records to be retained for three years?

The proper handling of a stop payment includes all of the following steps EXCEPT:

Which of the following is not likely to be in the skills set needed for a manager?

If an employee fails to furnish the employer with a Form W-4, the employer is required to withhold federal income tax at the rate of:

Copies of the production files and most recent payroll transactions are sent nightly to the parent company in a remote location. this practice is part of what type of plan?

Under the FLSA, which of the following restrictions apply when hiring minors under the age 18?

The Fair Labor Standards Act permits compensatory time off in lieu of overtime pay to which of the following employees?

Use of which of the following contributes to the security of the payroll system?

Which of the following employees is most likely to be an exempt professional under FLSA?

The fact that transactions affect two separate accounts of a business is called:

Which of the following features is LEAST likely to be considered when looking at the security of a new payroll system?

In keeping with internal control best practices, which of the following would probably not be included in the job description of a payroll specialist?

The entry to record an employee's repayment of a salary advance is (employee repays advance by personal check):

Transactions are recorded in chronological order into books of original entry called:

Employee Cindy's employer remits to her payment of $620 in 2009 for substantiated meal expenses she incurred while moving from her old residence to her new work location. What amount of this expense, if any is excluded from Cindy's federal taxable wages?

Which of the following would most likely be a key step in reconciling a payroll withholding account?

Choose the statement that represents the best implementation of internal control:

A company pays all executives semimonthly. The FLSA requires all other employees to be paid on:

Which of the following would NOT be correct in the treatment of deceased workers' wages, assuming the wages are paid in the year after the workers' death?

If an employee working abroad with a tax home in a foreign country passes the "physical presence test," to what may the employee be eligible?

An employee covered by group health insurance at the time his employment terminates to return to school is entitled to CORBA continuation rights for:

All of the following steps are required when initiating direct deposit for an employee EXCEPT:

Sally's department was scheduled to work from 8:00 a.m. until 5:00 p.m. It was announced to all employees that a severe winter storm was expected to reach the city between 4:00 p.m. and 5:00 p.m. Employees of Sally's department asked if they, like most other departments, would be allowed to leave work at 3:00 p.m. to avoid being caught in the storm. Sally was sympathetic, but after much discussion denied the request, stating that the policy was clear that employees were to remain on duty until 5:00 p.m. Which of the following management styles is Sally demonstrating?

Jane voluntarily separated from employment. She is allowed to continue paying for her medical insurance at cost plus 2% under what legislation?

Using federal child support guidelines, calculate the maximum amount of support that can be withheld from an employee's semimonthly disposable earnings of $1,500.00. The employee is four months in arrears in making child support payments and has no other dependents.

As part of the implementation of a new payroll system, all transactions from the most recent actual payroll are processed in the new system prior to using the system to run payrolls. This is an example of what type of testing?

What is one of the major considerations when evaluating and selecting a software system for payroll?

Which of the following represents the best way of addressing an issue of an employee's poor task performance?

An employer that pays its state unemployment contributions after the due date of the Form 940 has its FUTA credit reduced by what percentage?

An employee contributes $2,000 on a pretax basis to a 401(k) qualified plan. How is this pretax contribution reported on the 2009 W-2?

Which of the following is usually considered an advantage for outsourcing payroll?