After calculating your company's profit for the year, you discover that:

(a) A non-current asset costing £2,000 has been included in the purchases account; the asset has not been included in the closing inventory figure; nor has it been depreciated by the normal 25% per annum

(b) Closing inventory of raw materials, costing £500, have been treated as closing inventory of stationery.

These two errors have had the effect of.

STU has an accounting period end of 31 December 20X8 During the year STU paid $4,800 for business insurance to cover the year to 30 June 20X9 The amount paid for business insurance for 30 June 20X8 was $4,500.

What is the insurance expense to be recognized in the statement of profit or loss of STU for the year ended 31 December 20X8? Give your answer to the nearest $

Refer to the Exhibit.

John Taylor commenced business on 1 March 2006, paying $1,000 cash into a business bank account. During the next month the following transactions took place.

The balance on the bank account at the end of the month is:

One of the main responsibilities of internal auditors is to check the operational systems within their organization to establish whether the system's internal controls are sufficient and in full operation.

Which THREE of the following are examples of internal controls?

GH operates an imprest system for petty cash, maintaining a float of $250 The following petty cash book extract is available for a week in March 20X6:

How much does GH need to transfer from the bank account at the end of this week In order to maintain the imprest system?

Refer to the Exhibit.

On 1 May year 1 a company pays insurance of $1,800 for the period to 30 April year 2

What is the charge to the income statement and the entry in the statement of financial position for year 1 ended 30 November?

Refer to the Exhibit.

A company has the following information available for the month of June:

The opening receivables balance was $124,600.

The closing receivables balance at the end of June was

Refer to the exhibit.

A company's gross profit margin has fallen from 40% to 38% in the last period.

Which three of the following would be possible explanations for this?

Who is responsible for ensuring that internal control systems operate efficiently?

Accounting records should be kept by all businesses for many reasons.

Which THREE of the following are reasons for keeping accounting records?

A trial balance should be extracted from the ledger accounts prior to preparing the final accounts because:

Non-current assets can be divided between intangible and tangible assets.

Which THREE of the following are intangible assets?

There are many types of fraud that can happen within a business. On example could be the theft of cash, concealing the theft by delaying banking or by making up the shortage from other sources.

What is this type of fraud called?

The external auditor seeks to provide an opinion on whether the accounts show a true and fair view

What is the international term for 'true and fair view'?

In relation to accounting coding systems in the computerized records of an entity, which of the following is true?

Refer to the Exhibit.

Your organization bought a machine for £50,000 at the beginning of year 1, which had an expected useful life of four years and an expected residual value of £10,000; the machine was depreciated on the straight-line basis.

At the beginning of year 4, the machine was sold for £13,000

The total amount of depreciation charged to the income statement over the life of the machine, and the amount of profit or loss on disposal was:

The answer is:

Your organization owed VAT of $22,700 at the beginning of the month.

During the month, it sold standard-rated goods with a net value of $600,000. Its purchases and expenses during the same month amounted to $188,000 including VAT. It paid VAT to the Revenue and Customs, of $33,400. The VAT rate is 17.5%

At the end of the month, the balance on the VAT account was:

Store Y believe customer XF will not be able to pay his £300 debt. Which ONE of the following day books should this 'bad debt' be recorded in?

LMN's totals for its sales day book and its cash receipts book for the month ended 31 January 20X6 are as follows

What is the total value for sales that LMN will post to the sales account in the nominal ledger for January 20X6?

Which of the following would meet the definition of a liability in accordance with the Conceptual Framework's definition?

The profit earned by Subramanian in 2006 was £ 50,000. He injected new capital of £12,000 during the year and withdrew goods for his private use that cost £4,000.

If net assets at the beginning of 2006 were £10,000, what were the closing net assets?

ABC produces accounts to the year ended 31 December annually Extracts from the most recent financial statements are.

Which of the following ratios is a liquidity ratio?

Refer to the Exhibit.

The Financial Accountant for a company is preparing the monthly bank reconciliation and has extracted the following information:

The correct cash book balance at the month end will be:

JW's debits total £10,502 for this period. JW's credits total £8,940.

What amount does JW's accountant need to include in the company's suspense account to make the transactions balance?

At the beginning of the year, an organization’s non-current asset register showed a total net book value for fixed assets of £86,000. The nominal ledger showed non-current assets at cost of £120,000 and provision for depreciation of £39,000.

The disposal of a non-current asset for £10,000, at a profit of £2,000, had not been accounted for in the non-current asset register.

After correcting for this, the net book value shown in the ledger accounts would be

On 31 December 20X6 GHI makes a bonus issue of 50,000 shares On this dale the nominal value of the shares is $1 and the market value is $3 GHI has a share premium account with a substantial credit balance. The share capital account is credited correctly in the nominal ledger. Which of the following statements is TRUE?

A sole trader made a net profit of $8000 for the year.

During the year, inventory increased by $500, receivables decreased by $800 and payables increased by $2400.

This would result in:

Which TWO of the following are treated as statutory deductions from an employee's gross salary?

Comany D recently purchased an intangible asset from CompanyJFY, which was priced at £150,500, which Company D paid, along a goodwill amount that totalled 25% of the asking price.

Company D has estimated that the purchased entity will have a useful life of 35 years. Company D has decided to amortise the cost of the new asset using the straight line method.

What will the amortisation figure per annum be for Company D's new entity?

Before lending to an entity, which TWO of the following pieces of information would a potential lender want to consider?

If an auditor expresses an opinion of `fair presentation' on a set of financial statements, this means:

A company is preparing its accounts to 30 November. The latest gas bill received by the company was dated 30 September and included usage charges for the quarter 1 June to 31 August of $5,700 and a service charge of $1,200 for the quarter 1 October to 31 December. It is estimated that the gas bill for the following quarter will be a similar amount.

What will be the amount of the accrual shown in the accounts at 30 November 2006?

A payment to a supplier has been credited to the supplier's account and debited to the bank account.

This would result in

Which of the following would require an adjustment to be made to the cash book?

(a) Unpresented cheques

(b) Receipts not yet credited by the bank

(c) A dishonoured cheque

(d) Bank charges

Refer to the Exhibit.

A business banks its takings for the week. The bank account at the start of the week shows an overdraft

Which of the following is the dual effect?

MHJ purchased an asset for £53,500, which incurred a delivery charge of £20,000. MHJ decided to set a depreciation rate of 15% per annum for the asset.

In its second year, the asset is re-valued at 180% of the net carrying value of the previous year.

What will be the asset's net carrying amount by the end of its second year?

A basic principle of accounting is that resources are normally stated in accounts at historical cost.

Which THREE of the following are alternative ways of measuring resources?

Below is some information about Company TYY:

TYY offers a wholesale price for Product P of £650 per 100 quantity.

TYY offers regular customers a 35% trade discount.

On every 15th of the month, TYY offers a 15% cash discount on sales.

MPU wants to make a purchase from TTY for the first time, of900 Product Ps on the 15th of June. How much will MPU pay for this purchase?

A company has profit before tax and dividends of £500000. The share capital consists of 1000000 ordinary shares of £1 each and 100000 10% preference shares of 50p each.

A 10p dividend was declared on ordinary shares.

Assuming there was no tax liability for the period, profit retained for the period was

Which one of the following internal controls is designed to prevent errors and fraud?

The issue of a company's shares for more than their normal value results in the creation of a

The petty cash imprest is restored to £500 at the end of each week. The following amounts are paid out of petty cash during week 23:

(a) Stationery - £70.50 (including VAT at 17.5%)

(b) Travelling costs - £127.50

(c) Office refreshments - £64.50

(d) Sundry payables - £120.00 plus VAT at 17.5%

The amount required to restore the imprest to £500.00 is:

Give your answer to 2 decimal places.

An organization’s cash book has an opening balance in the bank column of $4,850 credit.

The following transactions then took place:

(a) Cash sales of $14,500, including VAT of $1,500.

(b) Receipts from customers of debts of $24,000.

(c) Payments to creditors of debts of $18,000, less 5% cash discount.

(d) Dishonored cheques from customers amounting to $2,500.

The resulting balance in the bank column of the cash book should be:

In a cash flow statement, which one of the following would not be found under the section "cash flows from operating activities"?

Which of the following entries would result in the trial balance not agreeing?

(a) An invoice for £200 for electricity has been omitted from the ledgers

(b) A payment received from a customer has been posted to the accounts twice

(c) An invoice for repairs and maintenance has been charged to the non-current asset account

(d) A payment made to suppliers had been recorded in the cash book but not recorded in the supplier's account

The suspense account of a company was opened with a credit balance of $360 when the trial balance failed to agree.

This could have arisen because

Refer to the Exhibit.

The sales day book for the last month, appeared as follows:

The entries which should be made in the ledger accounts are:

The answer is:

An invoice for electricity has been debited to the supplier's account and credited to the electricity account. This would result in:

Which THREE of the following would be recorded as a debit balance in the trial balance?

HJK has maintained minimal accounting records during the year but has the following information available:

HJK charges a mark-up on all goods sold of 25%. What is HJK's gross profit for the year?

Different users have different needs from financial information. One of which is to know about the company's ability pay its debts

Which of the following users will have this need for information?

Refer to the Exhibit.

A club receives the following fees in its first two years of operations:

Entrance fees are to be recognized over a period of 5 years while life membership fees are to be credited over a period of 10 years.

The total amount of fees which will be recognized in the income and expenditure account for each of the two years is:

Accounting standards and company law both influence how assets and liabilities ate classified and presented in financial statements

An amount owing at the year end, due for repayment more from one year from the date that the statement of financial position is being prepared, will be

classified under which of the following headings?

A company's financial statements show a gross profit of $15 million. A major error in the inventory value system has been discovered resulting in an overstatement on opening inventory of $1.2 million and an understatement in closing inventory of $1.5 million.

What is the correct gross profit figure for the period?

The Finance Director of EFG company has made the following statements regarding the recording of expenditure relating to the entity's property, plant and equipment (PPE) in the nominal ledger.

Which THREE of the following statements are true?

At the end of the year, the non-current asset register showed assets with a net book value of £170,300. The non-current asset accounts in the nominal ledger showed a net book value of £150,300.

The difference could be due to a disposed asset not having been removed from the non-current asset register, which had.

The accounting concept which states that non-current assets should be valued at cost (or valuation) less accumulated depreciation, rather than their saleable value in the event of closure, is the.

The balance on LMN's cash account at 31 December 20X6 is $108,000 (debit) On performing the monthly bank reconciliation the following is discovered.

• a payment of $2,000 made to a supplier has not yet appeared on the bank statement,

• an automated receipt from a customer for $5,000 has not yet been recorded in the cash book, and

• a pigment to a supplier of $1,500 was incorrectly recorded in the cash book as $1,050

The balance showing on the bank statement at 31 December 20X6 is

Which of the following methods of inventory valuation is not acceptable in the UK for financial reporting purposes?

Refer to the exhibit.

The bookkeeper of Joshua Ltd has absconded with the petty cash. The following was available:

How much has the bookkeeper stolen during the year?

A public limited company declares a 10% final dividend.

The nominal value of the shares is 50p and the shares are currently trading, in the stock market, at a price of £2.

A shareholder who purchased 1000 shares at a price of £1.00 per share, will receive a dividend of:

Give your answer to 2 decimal places.

Your organization paid $120250 in net wages to its employees during the year.

Employees' tax and national insurance amounted to $32000 and employers national insurance was $11000. Employees had contributed $6250 to a superannuation scheme.

The amount to be charged against profits for the year, in respect of wages is

In a cash flow statement, which one of the following would not be found under the section "cash flows from financing activities"?

Which of the following are relevant to the total working capital days ratio calculation?

M Ltd owns property costing $80,000 ($50,000 for the land and $30,000 for the building).

The company's accounting policy is to depreciate buildings at the rate of 5% per annum on the straight-line basis.

After five years, what is the net book value of freehold land and building in the financial accounts of M Ltd?

Which of the following would be a good method of segregating the duties of staff?

Refer to the exhibit.

Which three of the following would be classified as a revenue reserve?

Jasper has an opening capital balance at 1 January of $84,650 credit. During the period there was an increase in assets of $16,890 and an increase in liabilities of $22,480.

The balance on the capital account at the end of the period is:

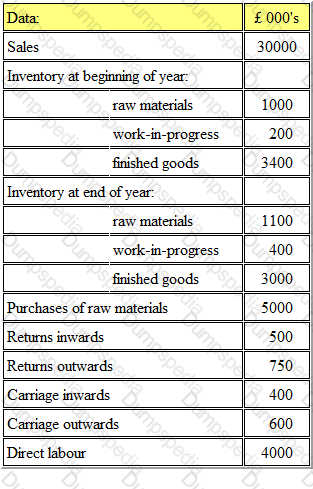

Refer to the Exhibit.

The following information is available for the period for AC Limited, a manufacturing company:

The factory cost of goods completed for the period was

Which one of the following would not be considered a purpose of segregation of duty?

Refer to the Exhibit.

The following information relates to a business at its year end:

The prime cost of goods manufactured during the year is:

Which of the following are examples of indirect costs for a chocolate manufacturing business?

The total of the debit column of a trial balance is $800 bigger than the credit column.

Which of the following is the entry recorded in the suspense account?

Entity HJ is a small business. In the period. Entity Hj earned revenue of £24,300, had opening inventories of £1,500 and closing inventories of £8,000. Purchases came to £13,200.

What was Entity Hj's gross profit or loss for this period?

The method of accounting that attempts to recognize changing price levels by applying an industry or asset specific price index to the cost of goods sold and assets consumed is known as:

A company that is VAT-registered has sales for the period of $245,000 (excluding VAT) and purchases for the period of $123,375 (including VAT). The opening balance on the VAT account was $18,000 credit. The VAT rate is 17.5%.

What will be the closing balance on the VAT account at the end of the period?

AB sold a machine for $15,000 The machine had originally cost $160,000 and al the dale of disposal had a carrying value of $26,000.

The journal entry lo record this disposal is:

A)

B)

C)

D)

A business buys a new production line at a cost of £100,000. After using the line for one year a more advanced version of the line is marketed by the manufacturer. As a result the production line in operation has a market value of £ 50,000. The line is being depreciated straight line over five years.

The charge to the income statement for impairment of the production line will be

Fraud can be conducted by employees or management. Management fraud can be hard to detect and may not seem like fraud at all as often company performance improves.

Which ONE of the following would be an example of management fraud?

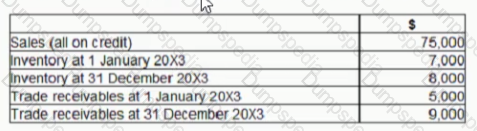

Refer to the Exhibit.

From the following information, calculate the value of sales for the period:

Value of sales is

Refer to the exhibit.

The following information is available about the ordinary shares of a public limited company:

A shareholder who purchased 20,000 shares at a price of $1.90 will receive a dividend of

An external audit is an independent examination of, and expression of opinion on the financial statements of an entity.

Who of the following appoints the external auditor?

FGH has extracted its trial balance from its nominal ledger for the year ended 31 March 20X6 The items below have a value greater than SNil Which are debit and which are credit balances?

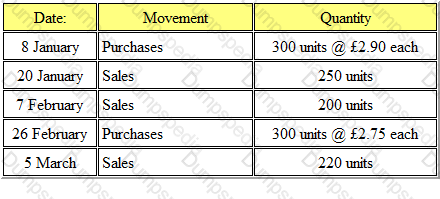

Refer to the Exhibit.

A company operates a FIFO system of inventory valuation. Opening inventory at the beginning of the period was 200 units @ £2.80 each. During the period the following movements of inventory were recorded.

The value of the closing inventory at the end of the period and amount charged to the income statement were:

AB commenced trading on 1 January 20XS. introducing $50,000 cash and $15,000 of assets to the business. The profit earned and retained in the business for the year ended 31 December 20X6 was $160,000. AB's closing capital at 31 December 20X5 was $190,000.

What is the value of AB's drawings for the year ending 31 December 20X5?

The statement of cash flow is a primary statement.

Which of the following gives the best description of the information provided to users by a statement of cash flow?

MM does not maintain complete accounting records. The following information is available for the year ended 31 December 20X3:

The mark up on items sold by MM is 20%.

Which THREE of the following statements are true?

Refer to the exhibit.

Jordan has the following assets and liabilities at 1 January:

What is the capital balance at 1 January?

A business may have thousands of transactions in any one accounting year. To trace the details of one of those transactions could be very difficult

Which of the following would be a way to make this easier?