Refer to the Exhibit.

PD manufactures a product in a process operation. Normal loss is 5% of input and occurs at the end of the process. The following data is available for the month of August:

Scrapped units have no value.

There was no opening or closing work in progress for August.

What is the value of the abnormal gain in August?

During the completion of Job A, £1,000 worth of material was transferred to it from Job B which had finished ahead of schedule.

How will this be inputted into the Job B account?

Refer to the exhibit.

Patchit Limited operates a job costing system. They have been asked to quote for a rush job that will require to be done in overtime hours. It is estimated that the job will incur the following costs:

Production overheads are absorbed on a direct labour hour basis. Budgeted direct labour hours for the year were 50,000 and budgeted direct labour cost was $300,000.

If production overheads had been based on a percentage of direct labour cost, the revised production costs for the job would be:

The production manager of your company has asked you to explain the methods of overhead analysis used, in particular the meaning of reciprocal servicing.

Reciprocal servicing is:

In an integrated cost and financial accounting system, the accounting entries for charging gross direct wages to production would be:

Refer to the exhibit.

The profit/volume graph below has been prepared for a product for which the following data are available for a period:

Selling price - $28 per unit

Variable cost - $23 per unit

Fixed cost - $4 per unit

Forecast sales volume is 1,000 units each period.

The value of P in units is:

Place the following budgets in the order that they would be prepared. Assume that sales volume is the principal budget factor:

(a) Production

(b) Materials usage

(c) Sales

(d) Materials purchases

Refer to the exhibit.

The following data relate to two activity levels of an enquiry-handling centre:

The amount of fixed overheads is:

Refer to the exhibit.

Data for October's budget for product Quest for the month of October are given below:

Each unit of Quest requires 6kg of raw materials. Strict quality control procedures are applied to the manufacturing process and normal rejection levels are 5% of finished units.

The raw materials purchases budget for the month of October is:

The management accountant has completed the appraisal of an investment in new office equipment.

It has now been discovered that the cost of capital used in the appraisal should have been higher.

What will be the effect on the calculated net present value (NPV) and the payback period?

Refer to the exhibit.

The following data refers to a manufacturing process for the month of July:

The work in progress is completed as follows:

(a) 100% for material

(b) 80% for labour

(c) 60% for overhead

The value of the work in progress is:

Refer to the Exhibit.

The following forecast cash flows relate to a proposed investment in new delivery vehicles at a total cost of $75,000.

The internal rate of return (IRR) of the proposed investment is (to two decimal places)

CL produces a household detergent in a single process. Information for this process for last month is as follows:

(a) Materials input – 11,000 Litres at £2.00 per litre.

(b) Conversion costs - £23,000

(c) Output during the month – 8,000 litres.

(d) There were 2,000 units of closing work in progress which was complete as to materials and 35% complete as to conversion.

(e) Normal loss for the month was 5% of input and all losses have a scrap value of 50p per litre.

(f) There is no opening work in progress.

What was the value of normal loss during the month? Give your answer to one decimal place.

Refer to the exhibit.

Data from the management accounting reports for the DD Division of a company for the latest period are as follows.

The value added for the DD Division for the latest period was

Refer to the exhibit.

Which is the correct journal entry required to record an adverse labour rate variance in an integrated accounting system?

The correct journal entry required to record an adverse labour rate variance in an integrated accounting system is:

Refer to the exhibit.

RX Ltd expects to have limited machine time for July, which will result in the following production levels:

It is anticipated that there will be 1,500 units of opening inventory and the company wishes to hold a minimum of 500 units of closing inventory at the end of July.

How many units will be available for sale during July?

Refer to the exhibit.

The standard variable cost per unit of Product W is $26. The budgeted sales of Product W in April was 3,300 units. The company recorded the following variances for the month of April:

During April 3,600 units of Product W were actually sold.

The budgeted contribution for Product W in April was to the nearest $000:

CL produces a household detergent in a single process. Information for this process for last month is as follows:

(a) Materials input - 11,000 Litres at £2.00 per litre.

(b) Conversion costs - £23,000

(c) Output during the month - 8,000 litres.

(d) There were 2,000 units of closing work in progress which was complete as to materials and 35% complete as to conversion.

(e) Normal loss for the month was 5% of input and all losses have a scrap value of 50p per litre.

(f) There is no opening work in progress.

The value of finished output during the month (to the nearest £) was:

Johnson & Smith is a huge corporation with many different departments covering hundreds of activities. They had switched to this new budgeting technique as it seemed as though it would help them allocate their

limited funds better.

It was successful to some extent as each manager was required to look at every cost his department accrued. They would then be responsible for coming up with new ways of performing these activities.

It became obvious that certain managers were unable to handle these paperwork intensive demands and so the company will be reverting back to a system that focuses primarily on cost drivers next year.

What budgeting technique will they be using next year?

During Period 8, 120kgs of material 'X' was purchased for a total cost of £1,920. This resulted in a materials price variance of £240 adverse.

What was the standard price per kg of Material 'X'?

Refer to the exhibit.

The management accountant has completed the appraisal of a project which is forecast to generate the following cash flows.

It has now been discovered that the cash inflow in year 3 has been overestimated.

What will be the effect on the calculated net present value (NPV) and the payback period?

Which THREE of the following costs would normally be classified as semi-variable?

Refer to the exhibit.

Which is the correct journal entry required to record a favourable material usage variance in an integrated accounting system?

The correct journal entry required to record a favourable material usage variance in an integrated accounting system is:

According to CIMA’s Code of Ethics, CIMA members should not allow bias, conflict of interest of the influence of other people to override their professional judgement.

This is an example of:

Based upon extensive historical evidence, a company’s daily sales volume is known to be normally distributed with a mean of 1,728 units and a standard deviation of 273 units.

What is the probability that, on any one day, the sales volume will be at least 1,300 units?

The following data relate to the latest period.

A statement is to be prepared that reconciles the difference between the flexible budget profit and the actual profit.

Which TWO of the following will appear on this statement? (Choose two.)

A company operates an integrated standard cost accounting system. The standard price of raw material A is $20 per litre. At the start of period 1, the inventory of 500 litres of raw material A was valued at $20 per litre. During period 1, 100 litres of raw material A were purchased at an actual price of $21 per litre. During period 2, 550 litres of raw material A were issued to Job 789.

In respect of the above events, which TWO of the following statements are correct? (Choose two.)

The following data are available for a company that produces and sells a single product.

The company’s opening finished goods inventory was 2,500 units.

The fixed overhead absorption rate is $8.00 per unit.

The profit calculated using marginal costing is $16,000.

The profit calculated using absorption costing and valuing its inventory at standard cost is $22,400.

The company’s closing finished goods inventory is:

In a manufacturing company which produces a range of products, the wages of a machine operator in the factory would be classified as a:

Refer to the exhibit.

Budgeted data for the manufacture of Product X is given below:

Each unit of Product X requires 6 labor hours. It is expected that idle time will account for 5% of labor hours. Products are quality checked and normal rejection rate is 10% of completed units.

The budgeted direct labor hours required for Product X is:

Refer to the exhibit.

The indirect costs of a hospital's Radiology Department consists mainly of equipment related costs. Details of the budget for Period 4 are:

The most appropriate overhead absorption rate is:

Refer to the exhibit.

The following budget details are available for Superkite Limited which manufacture a single product:

The raw materials purchases budget is

Refer to the Exhibit.

AM Ltd. makes and sells a single product for which the standard cost information is as follows:

What is the variable overhead expenditure variance?

Which of the following is the LEAST appropriate basis on which to apportion the insurance costs of plant and machinery:

Refer to the exhibit.

The prime cost of product 'Z' is as follows:

Overheads are absorbed at £4.00 per labor hour in Department 1 and £6.00 per labor hour in Department 2.

The production cost of Product Z, to the nearest £, will be:

Give your answer to 2 decimal places.

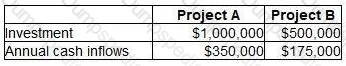

A company is appraising two projects. Both projects are for five years. Details of the two projects are as follows.

Based on the above information, which of the following statements is correct?

A company that uses standard costing wishes to reconcile the difference between the profit for a period calculated using absorption costing with that calculated using marginal costing.

Which TWO of the following will NOT help with this reconciliation? (Choose two.)

The International Federation of Accountants (IFAC) stated that it was important that “accountants in business” should understand what the drivers of stakeholder value are. Which of the following statements is valid?

A company’s management accountant wishes to calculate the present value of the cost of renting a delivery vehicle. There will be five annual rental payments of $5,000, the first of which is due immediately. The company’s discount rate is 12%.

Which TWO of the following are valid ways to calculate the present value of the rental payments? (Choose two.)

Which of the following statements about CIMA's role in relation to its students is correct?

i. CIMA's professional conduct staff process complaints made against CIMA students

ii. Students are not governed by CIMA's code of ethics until they become registered CIMA members

iii. Students may consult CIMA about situations in their work place that appear to conflict with CIMA's code of ethics

iv. Once students have passed all of the CIMA exams they may use the designatory letters ACMA

A company manufactures laptop computers. Which of the following would be classified as direct labor?

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 800 units. Actual output was 1000 units. The details of the costs are shown below:

The budget expenditure variance was:

A company hires a delivery vehicle for $200 per day plus $2 per kilometre travelled. The total hire cost would be described as:

When compiling profit statement using a marginal costing system we must calculate the contribution. Once we have the contribution, we must deduct a specific amount to calculate the profit. Which of these values

should we NOT deduct? (Select ALL that apply.)

Refer to the exhibit.

John Brown is a machine operative in a manufacturing company. An analysis of his gross pay for the week is given below:

During the week John was idle for 6 hours due to machine breakdown and maintenance.

The total indirect labour costs included in John's gross pay was:

Refer to the exhibit.

The following budget and actual data are available for last period.

The sales price variance for last period was

JB has fixed costs of $120,000 per annum. It manufactures a single product which it sells for $12 per unit. It has a profit/volume ratio of 60%.

JB’s break-even point is

Refer to the exhibit.

The budget for WP for the month of September contained the following data:

During the month the actual number of units produced was 1,860. The management accounts showed a direct material price variance of $1,200F and direct material usage variance of $180A. The direct materials purchased were 1,200 kg.

The actual quantity of material used in the month was

The following list contains many different types of costs for a business. However, only four of them would be considered costs centres. Which four?

Refer to the exhibit.

SP, a manufacturing company, uses a standard costing system. The standard variable production overhead cost is based on the following budgeted figures for the year:

During the month of September, 5,300 actual hours were worked and 5,600 standard hours of output were produced. Total variable production overhead costs in September were $8,600.

What was the variable overhead efficiency variance in September?

It is company policy that the closing inventory of finished goods must be equal to 10% of the following month's budgeted sales. The budget sales for November and December are 8,000 and 9,000 units respectively.

The budgeted production for November will be:

A company’s cash budgetary plans show that there will be surplus cash for three months of the forthcoming year.

Which THREE of the following would be appropriate management actions in this situation?

Each unit of product GM requires 4 labour hours to be produced. 25% of the units will be completed during overtime hours.

Sales of 24,000 units are planned and finished goods inventory is budgeted to rise by 2,000 units.

If the wage rate is £6 per hour and the overtime premium is 50%, what is the budgeted labour cost?

A budget that is continuously updated by adding a further accounting period when the earliest period has expired is known as:

In an integrated cost and financial accounting system, the accounting entries for the payment of net wages to indirect production workers would be:

Which one of the following is an example of operational management information?

Refer to the exhibit.

X Enterprises runs a private nursing home for the elderly. The company are concerned that bed occupancy rates have been falling over the past 2 years with a consequential effect on profit. They have drawn up a budget for next year as follows:

The nursing home currently charges $90 per patient day.

The nursing home operates at 7,500 patient days per year. In an effort to increase occupancy rates the company are proposing to reduce the current price by 10% and increase spending on advertising by $10,000 each year. What effect will this have on the margin of safety?

Which one of the following is NOT one of the five stated fundamental principles of CIMA's code of ethics?

Refer to the exhibit.

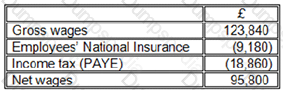

DS is manufacturing company that uses an integrated accounting system. The following payroll data is available for the month of August:

The Employers' National Insurance for the period was $13,790. An analysis of the wages is as follows:

Which of the following factors affect the budgeted cash flow:

(a) Funds from the issue of share capital

(b) Bank Interest on a long term loan

(c) Depreciation on fixed assets

(d) Bad debt write off

A company uses an integrated accounting system.

The accounting entries for the sale of goods on credit would bE.

Refer to the exhibit.

The following information relates to Job 123:

The selling price to the customer for Job 123 is:

Which one of the following is a characteristic of strategic financial information?

Refer to the Exhibit.

PJ Ltd has forecast that the relationship between total overheads and machine hours will be as follows:

If the budget is to be based on 4,000 machine hours, the variable overhead absorption rate will be:

*per machine hour.

Give your answer to 2 decimal places.

An increase in the variable cost per unit, will cause the point at which the line plotted on a profit/volume (PV) graph intersects the horizontal axis to:

Eton Ltd. operates a manufacturing process that produces product A. Information for this process last month is as follows:

(a) Opening work in progress - 2,500 kg valued at £2,000 for direct material and £1,500 for labour and overheads.

(b) Materials input - 25,000 kg at £2.10 per kg.

(c) Labour - £10,000

(d) Overheads - £5,000

(e) Output during the month - 20,000 kg.

(f) There were 7,500 units of closing work in progress which was complete as to materials and 30% complete as to conversion.

(g) Normal loss for the month was 3% of input and all losses have a scrap value of £1 per kg.

What was the average cost per kg of finished output during the month?

If the fixed costs are increased, the point at which the line plotted on a profit/volume (PV) graph cuts the horizontal axis will:

Refer to the exhibit.

T operates a process costing system. Data is available for Process A for the month of July.

Inputs for the month:

Normal losses are 15% of input and can be sold for $6 per kg. Actual output was 2,600 kg. There is no opening or closing work in progress for the period.

What is the value of the output from the process in the month?

A company operates a full cost system of pricing. Production overheads are absorbed using a pre-determined absorption rate of £3.50 per machine hour. The direct production cost of product A is £15 per unit and it utilises 6 machine hours per unit. The mark-up for non-production costs is 10% of total production cost. The company wants to make a 25% return on sales revenue for all products.

The required selling price for Product A, to two decimal places, is:

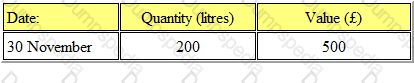

Refer to the Exhibit.

Fabex Ltd manufactures a household detergent called "Clear". The standard data for one of the chemicals used in production (chemical XTC) is as follows:

(a) 50 litres used per 100 litres of 'Clear' produced

(b) Budgeted monthly production is 1000 litres of 'Clear'.

The closing inventory of chemical XTC for November valued at standard price was as follows:

Actual results for the period during December were as follows:

(a) 500 litres of chemical XTC was purchased for £1300.

(b) 550 litres of chemical XTC was used.

(c) 900 litres of 'Clear' was produced.

It is company policy to extract the material price variance at the time of purchase.

What is the total direct material price variance (to the nearest whole number)?

In the process account, the accounting treatment of the value of the abnormal gain is:

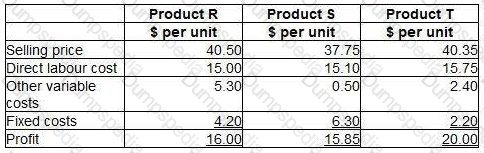

A company manufactures three products using the same direct labour which will be in short supply next month. No inventories are held. Data for the three products are as follows:

The fixed costs are all committed costs and cannot now be altered for the next month.

Place the labels against the correct product to indicate the order of priority for manufacture that will maximise the profit for the next month.

A new product requires an investment of $200,000 in machinery and working capital. The total sales volume over the product’s life will be 5,000 units. The forecast costs per unit throughout the product’s life are as follows:

The product is required to earn a return on investment of 35%.

What unit selling price needs to be achieved?

A company which manufactures and sells one product has fixed costs of $80,000 per period. The selling price per unit of $25 generates a contribution/sales ratio of 40%.

How many units would need to be sold in a period to earn a profit of $10,000?

The year-to-date results at the end of month 9 included sales revenue of $3,600,000 and variable costs of $2,100,000.

During month 10, sales revenue was $450,000 and variable costs were $270,000.

What year-to-date contribution to sales ratio (C/S ratio) would be reported at the end of month 10?

An organisation’s management report contains the following data:

Which division has the highest operating margin percentage?

A company has two production departments and two service departments (Maintenance and Stores). The overhead costs of each of the departments are as follows.

The following equations represent the reapportionment of each of the service department overheads to the other.

M = 4,700 + 0.1S

S = 5,800 + 0.2M

Where M = total Maintenance overhead after reapportionment from Stores

S = total Stores overhead after reapportionment from Maintenance

60% of the total Maintenance overhead and 50% of the total Stores overhead are to be apportioned to Production Department 1.

The total production overhead for Production Department 1 after reapportionment of the service departments’ overhead costs is closest to:

A company absorbs production overhead using a direct labour hour rate. Data for the latest period are as follows:

What is the overhead absorption rate per direct labour hour? Give your answer to one decimal place.

A company makes and sells a range of products. The standard details per unit for one of these products, product X, are as follows.

To meet sales demand, the company must obtain 2,000 units of product X next month. There is sufficient labour capacity to produce 1,500 of these units in-house during normal time. However, any production above this level would require overtime working which would be paid at a premium of 50%.

The company can buy as many units of product X as it wishes next month from an external supplier at a price of $120 per unit.

What is the total financial benefit to the company of purchasing the appropriate number of units from the external supplier rather than producing them in-house?

A company is considering investing $57,000 in a machine that will last for five years, after which time it will have no value. The machine will generate additional revenue of $190,000 each year. Annual running costs, including depreciation of $11,400 will amount to $168,400.

Assuming that all cash flows occur evenly, the payback period of the investment in the machine is closest to:

A company wishes to compare the variability of its monthly sales revenue in country A with that of country B. The two countries use different currencies.

The monthly sales revenue for the last 48 months in country A (which is measured in $) has been analysed as follows.

What is the coefficient of variation of this data?

Give your answer as a percentage to one decimal place.

A management accountant has forecast the following cash inflows from four potential projects.

All four projects require the same initial investment and will last for four years. They all result in a positive net present value but only one of the projects can be undertaken.

Which project should be selected?

Which THREE of the following are included in the Global Management Accounting Principles? (Choose three.)

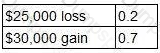

A project is about to be launched. Two of the three possible outcomes and their associated probabilities are as follows:

The remaining possible outcome is a $70,000 gain.

What is the correct calculation of the expected value of the project?

In a company that manufactures many different products on the same production line, which TWO of the following would NOT be classified as indirect production costs? (Choose two.)

Which of the following would NOT be an appropriate performance measure for a profit centre manager?

Which TWO of the following are characteristics of Management Accounts? (Choose two.)

Assume that a unit of output is the cost object. Which of the following statements is valid?

A small airport’s management accountant has prepared the following management report on the performance of its four retail outlets.

Which retail outlet has the highest contribution per square metre?

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period.

The sales volume contribution variance for the period was:

A confectionery manufacturer is considering adding a new product to the current range. Forecast data for the product are as follows.

Incremental fixed costs attributable to the new product are forecast to be $24,000 each period.

The forecast sales volume of 180 units is insufficient to achieve the target profit of $10,000 each period.

Which of the following statements is correct?

A company has three production departments X, Y and Z, and one service department.

The service department’s overhead has been apportioned to the production departments in the ratio 3:2:5. As a result of this apportionment, $2,070 was given to Department Y.

What is the amount of service department overhead that would have been apportioned to Department Z? Give your answer to the nearest dollar.

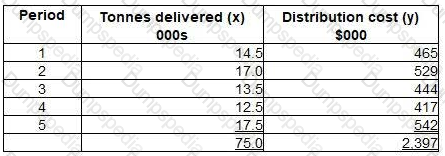

The following data are available for a delivery company. The table shows the number of tonnes delivered (x) and the associated distribution cist (y) in recent periods.

Further analysis of this data has determined the following:

∑xy = 36,427∑x2 = 1,144

Using least squares regression analysis, calculate the variable cost per tonne delivered. Give your answer to the nearest cent.

Data for the latest period for a company which makes and sells a single product are as follows:

There were no budgeted or actual changes in inventories during the period.

The variable overhead expenditure variance for the period was: